PPR is no stranger to real estate. In fact, it’s our bread and butter. In our largest operating fund to date, the Reliant Income Fund, the bulk of our portfolio is dedicated to Non-Performing Loans (NPLs) – mortgage loans backed by residential properties nationwide. NPLs are the foundation of our business, and we expect them to remain a substantial part of our book in the years to come.

However, that’s not the only area of real estate in which we participate. Over the past 4 years, we have branched out strategically into commercial investments. As of mid-2024, this vertical makes up about 25% of our portfolio, accounting for approximately $225 million dollars’ worth of diversified multifamily investments located all across the country.

Recently investors have been asking why we’ve expanded into this sector and why we are confident acquiring new properties in this current economic environment. It’s probably best to first discuss the market we’re in and what got us here…

The Sea Change

With the onset of the COVID-19 pandemic, it wasn’t too long after we entered the space that we noticed a spike in pricing for multifamily properties. That was due to two major reasons: interest rate cuts and a general surge in demand for residential real estate.

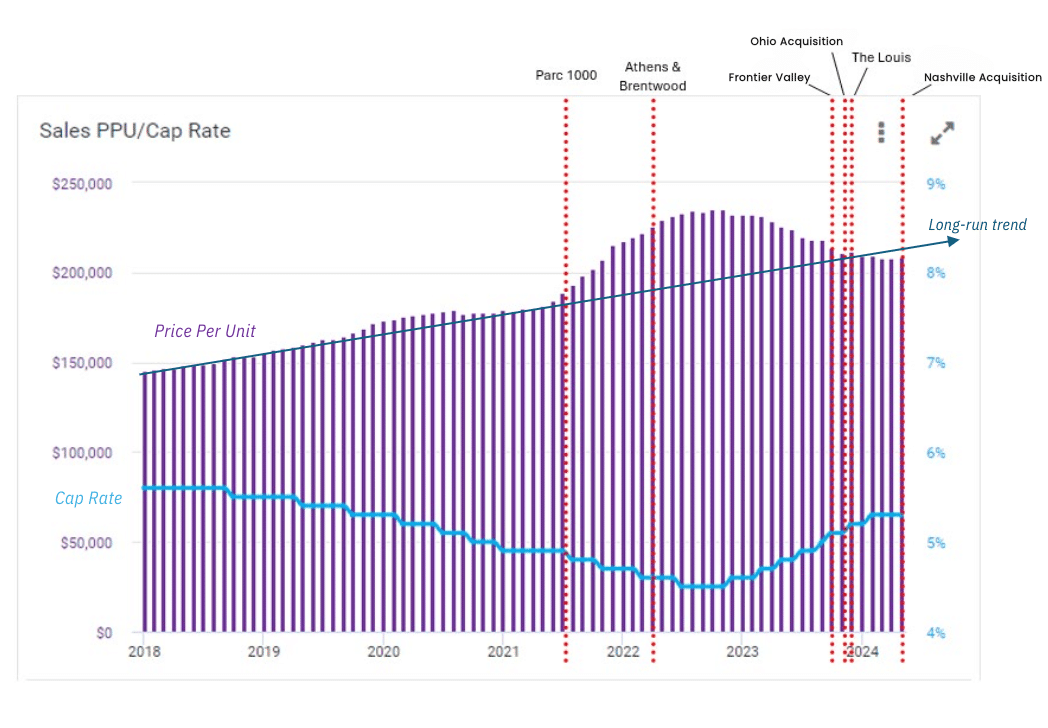

But why does that matter and how does that affect multifamily valuations? Well, a lower interest rate environment improves pricing for multifamily properties as it results in lower capitalization rates required by buyers (i.e. the percentage of purchase price earned by the property as income each year). Simultaneously, the increased demand led to a dramatic rise in both rental payments and home prices. According to RealPage, these combined effects increased values by approximately 35% on average in a period of just 18 months from late 2021 to mid-2023.

A Seller’s Market

As owners could see this rapid growth in income and valuations, many decided to sell off large parts of their portfolios to realize their gains. Meanwhile, being in an upmarket, operators of multifamily funds and syndications were able to raise vast amounts of capital from retail investors by being able to point to realized returns of 25%+ on their most recent deals. All in all, RealPage data shows that annual multifamily transactions peaked in mid-2022 at nearly $400 billion in assets sold.

Investors’ Perspective

Because so many property owners sold at 2022/2023 peaks and reinvested their proceeds, the average age of an existing multifamily investment today is relatively low. Investors who acquired properties before the boom (in 2020 or earlier) continue to experience value growth not far off from the long-run trend.

However, investors who acquired properties or invested in many funds/syndications in the mid-2022-2023 period were highly vulnerable to changes in market conditions. The sudden increase in rental demand triggered an increase in supply to absorb the excess profits. According to Moody’s Analytics, national multifamily units under construction rose from 700,000 in 2021 to over 1.1 million units by the end of 2022. As interest rate hikes took hold in 2023 and throughout 2024, this oversupply of multifamily quickly caused peak pricing to decline from the recent boom in the marketplace. Rents and occupancy rates fell as new supply saturated formerly profitable markets, while the Fed increased interest rates to tackle rising inflation. Prices subsequently retreated, with RealPage estimating that price per unit nationwide fell over 10% from Q3 of 2022 to Q1 2024.

Regional Markets

It’s important to note that both the surge and subsequent drop in rents, occupancy and pricing were not evenly distributed across the country. The so-called “growth” markets of the South/Southeastern United States (i.e. Miami, Houston, Austin, Charlotte, Charleston, Nashville, Phoenix, Dallas, Atlanta) that had seen huge demand pressures during the pandemic, experienced a large correction. On the other hand, more stable markets, such as those in the Midwest, remained largely unaffected, experiencing continued rent growth, lower levels of construction, and healthy occupancy rates.

So where does that leave us?

PPR’s positioning

After a thorough research and development phase, PPR entered the multifamily space in earnest in 2021. While market conditions have been challenging, we have so far successfully navigated this dynamic. We intentionally paused commercial acquisitions from June of 2022 to October of 2023 while the rising interest rate environment took hold. Properties we acquired during the peak are currently stable and on target. We resumed purchasing in late 2023 as distressed properties from this environment started to enter the marketplace. Since then we’ve been opportunistic, seeking acquisitions that have specific facts and features that make them advantageous to our portfolio, but overall the acquisition theme is actually simple: it’s based on rigorous due diligence based on data and analysis.

Figure 1: Dropoff in values occurs after the 2022-2023 peak. Note that PPR paused multifamily acquisitions for ~18 months during this period.

PPR’s due diligence and analysis is data centric

Our CIO, Spencer Staples, is a multi-award-winning MarketWatch economic forecaster and invests heavily in world-class data on the multifamily industry. While the multifamily industry is largely still data-poor and operates more on narrative, we strive to obtain and analyze as much objective data as possible and marry that with knowledgeable commentary from our experts on the ground.

We conduct our underwriting using an array of reliable data sources, and through robust internal modeling and analysis, we can determine the most probable future conditions for every property in which we invest. Our spectrum of due diligence processes analyzes the structure of both the Sponsor and the Property itself on any given investment, which explores scenarios that discover, mitigate, and reduce risk in any given deal.

PPR has entered both stable and growth markets since the beginning, but in every case, we are focused on key deal-level facts and underwriting that benefit the transactions.

Why 2024 is the time for us to buy?

In the current climate, we’ve found that some funds and syndicators are pausing distributions with some even resorting to capital calls to salvage or “rescue” loans to keep from losing their assets entirely and wiping out their investors’ equity. Through rigorous financial management, PPR has available capital (“dry powder”) enabling us to take advantage of current market conditions and obtain positive terms/returns from deals in need of equity.

Additionally, this market doesn’t scare us. When necessary, we can take a defensive approach, and deploy our capital into other diversified channels such as NPLs. This enables us to be opportunistic and patiently wait for multifamily deals where the macro and micro environments meet our desired risk/reward strategy.

Lastly, we don’t look at the multifamily challenges over the past 18-24 months as a warning against investing in the space overall. With a track record of never having missed a preferred payment (193 months and counting), we have built a satisfied customer base who can be a reliable capital resource to take advantage of the recent significant price reductions. As a result, in 2024 our plan is to stick to our strategy of investing in NPLs and quality commercial properties that together strengthen the health of the fund and ensure investor satisfaction.