In a previous webinar that explained why we were making a $100M+ commitment to the Non-Performing Loan (NPL) asset class in Q4 2023 alone, we received positive feedback on our explanation on the “lifecycle” of a mortgage loan. As a follow-up based on questions we got, I wanted to take the time to elaborate a bit more for those who are newer to the PPR community or those who want a quick refresher on how investing in the NPL asset class works.

First, keep in mind that many people are already “in the mortgage business” – it’s just that they happen to be on the borrower end of it. The life of a loan starts when (more than half of all) Americans walk into a bank or mortgage broker’s office in need of a home mortgage, home equity loan, or line of credit.

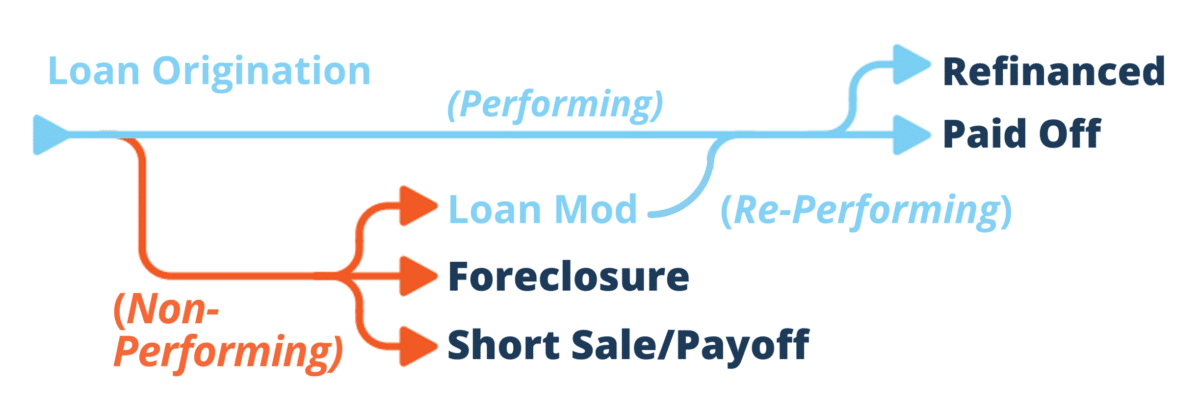

Once obtained, a mortgage only has two paths it can take:

- Performance. The borrower makes their monthly mortgage payments until the loan is paid off or they refinance or sell the home. That is what is considered a ”performing” mortgage.

- Non-Performance. With a small percentage of loans, the borrower experiences a life circumstance that cause them to be unable to pay their mortgage payments; this causes a loan to be termed “non-performing.” For example, let’s say a borrower is years into their mortgage but unfortunately experiences a major life event such as a death, divorce, job loss, or medical emergency. Due to this event, they fall behind on payments. After 90 days on non-payment, the loan is considered by a lender to be “non-performing” or “delinquent.”

At the point a loan becomes delinquent, the bank or lender usually has two options. First, they can modify the loan to meet the borrower’s current financial situation, but that isn’t their strength since they’re in the lending business not the loan restructuring business. Second, they can sell the mortgage to meet regulatory loan loss reserve requirements or their own liquidity needs, and get it off the books.

The second scenario is where a company like PPR comes in.

In the secondary market where loans are bought and sold, this example mortgage loan with a borrower who fell behind on payments is likely to be packaged up with other non-performing loans to be sold in bulk through a trade desk, loan exchange, or brokerage.

PPR, utilizing its private capital from investors, is one of the companies that could make a bid on a pool of mortgages. Given that we’re buying in bulk, we receive a discount off the book price, and so we’ve more flexibility to work with the borrower, modify the loan, or otherwise restructure the mortgage.

Exiting through the borrower

Aside from re-selling the mortgage soon after purchase, there are several options for us as an asset manager who has invested capital to buy these loans. We can either exit and recapitalize through working with the borrower or utilize an exit strategy with the property itself if the borrower can no longer legitimately continue to make payments.

The most common form of exiting through the borrower would be through a Loan Modification. This is essentially a redefined payment plan for the borrower that is similar to their original plan with the mortgage, but with adjusted terms and conditions. Clearly, every loan is different, as is every borrower, making for infinite combinations of back payments and new adjusted monthly payment options with a focus on affordability for the borrower themselves. A typical plan would

spread the reinstatement amount over a defined number of months along with the regular or reduced monthly payment.

A loan modification to get the loan “re-performing” is just one way we could recapitalize on our investment. Another type of plan instituted with a borrower includes a full or partial reinstatement and regular or reduced payments with the goal of refinancing. This option could take up to 12 months of re-performance and would usually require significant equity in the property.

We could also offer a discounted loan payoff, where we could accept less than the full payoff remaining on the loan. So, as the mortgage owner, we could offer a homeowner the opportunity to pay off their loan without incurring additional late fees and penalties that have been added. Some homeowners can even access a larger sum of capital in their 401(k) plan while in foreclosure, often without penalty, making this course of action a viable option for them.

We could also Reinstate the Loan – the loan would be considered reinstated when the amount of money needed to bring the past due loan current has been paid. The term for this past due amount of money is also known as “arrears”. Arrears can consist of missed payments, interest fees, late fees, and corporate advances (such as back taxes, HOA fees, legal fees, etc.). As a loan owner we can also accept a partial reinstatement or discounted arrears plan to recapitalize sooner rather than later.

Seller Assistance is another strategy to expedite the exit of an asset. So, for example, if a borrower can’t afford to stay in the property, PPR, as the new mortgage owner, can assist them in helping pay for a realtor, mover, or even a down payment on a new home. We also have the flexibility to have the borrower stay in the property until it sells and could even pay a commission if they found a buyer or tenant for the property.

Exiting through the Property

We’ve covered multiple exit strategies that may work with the borrower, but there are still many instances where it makes sense to exit by disposing of the property. This strategy can be a natural progression if the borrower no longer wants the property or lives there (like in the case of a reverse mortgage).

The first option here is what is known as obtaining a “Deed in Lieu of Foreclosure.” If a homeowner cannot afford to stay in the property or no longer wants to live there, as the loan owner we can offer “cash for keys” where they sign over the deed in lieu of going through the foreclosure process, saving the homeowner the impact that could have on their credit as well as saving us quite a bit of time in the recapitalization process.

The other, often more common option for us, is obtaining the property via REO. Whether it’s through a foreclosure process or upon buying vacant 1st liens, as a loan owner we can take possession of the property through a sheriff’s deed. Then we have the ability to resell the property as is, rent it out, renovate it and flip it, or even offer owner financing to a buyer, thereby achieving what may be the most advantageous return on our investment. We typically list these renovated properties with a REO agent and, with the proceeds from these and other exit strategies, we recapitalize and pay our investors.

If you’d like to learn more about these strategies, feel free to contact our Investor Relations team or read PPR co-founder Dave Van Horn’s full-length book, “Real Estate Note Investing,” which goes into even more detail on mortgage loan investing and how it works.