PPR Capital Management

Investment Strategy

*Figures above updated on a quarterly basis

Strategy Overview

For over 16 years, PPR has been a proven leader in private equity real estate, focused primarily on distressed debt, institutional mortgages and commercial real estate. With a focus on capital preservation, we seek to utilize our expertise and trusted partnerships to deliver consistent risk-adjusted returns to our investors in any economic environment.

The How:

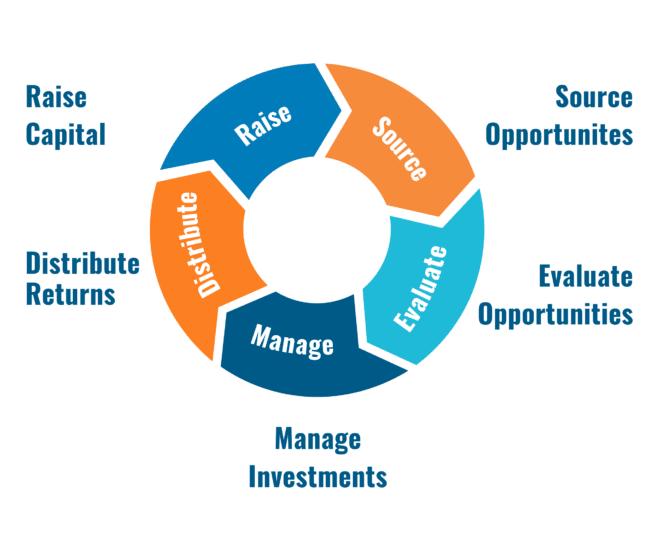

Our business model starts with you, the investor. Through our accredited investor network and institutional partners, we invest primarily in mortgage loans, residential, and commercial real estate. Our portfolio of assets is diversified geographically throughout the United States with varied investment time horizons and characteristics.

These investment opportunities are sourced directly or via joint venture partners who bring specific expertise in their region and asset class. Prior to any investment, we utilize proprietary economic analysis to conduct thorough due diligence to evaluate the loan trade or commercial project on a risk-adjusted basis. This analysis enables us to forecast returns against various market conditions.

Once selected for inclusion in the portfolio and we allocate capital, we then actively manage the assets through a team of portfolio managers and loan surveillance professionals, as well as work with our experienced joint venture partners throughout the lifecycle of the investment, from the time of purchase to disposition.

How It Works

Featured Strategy:

Real Estate Note Investing

PPR was initially founded as an asset manager in 2007, specializing in non-performing notes (i.e. real-estate-backed loans). Today, we buy, sell, and hold notes in our portfolio both as a direct asset manager and through Joint Venture partnerships.

The majority of NPL (non-performing loan) purchasing is done through a trade desk via government auctions (like FNMA, FMAC, and HUD) as well as through fund-to-fund transactions.

Acquisition Criteria:

-

1st Position

-

Nonperforming

-

Non-rural

-

Nationwide (price adjusted for foreclosure timeline)

-

FMV (fair market value) greater than $100k

-

UPB (unpaid principal balance) over $70k

Featured Strategy:

Commercial Real Estate

PPR utilizes their experience and extensive network to find, identify, and partner with time-tested sponsors and developers with a demonstrable track record.

We choose asset classes within the commercial space that have beneficial long-term supply/demand characteristics such as Class B or Affordable Housing located in areas with long term favorable fundamentals.

As a capital partner of these sponsors, we help acquire or construct properties of a sufficient size that can benefit from economies of scale, that will ultimately serve as a valuable addition to our overall portfolio.

Acquisition Criteria:

-

Properties located in the Sunbelt and other high-growth US markets

-

Class C+/B+ property with opportunity for strategic capital improvements

-

Well-located, underperforming multifamily properties

-

Properties in secondary markets which provide higher quality for affordability living

-

Opportunities that offer unique tax incentives

-

100+ unit assets or portfolios

-

Three to five-year holding period

-

$20M to $100M in total capitalization

Want a Snapshot of PPR and our Portfolio of Assets?

Download our Portfolio Update to learn more about what PPR does, how our real estate funds work, revenue trends and details, and see a current breakdown of the types of assets our portfolio contains.