In early 2024, we announced the closing of our first multifamily acquisition in the thriving Kansas City market. We’re excited to report that we’ve now had the opportunity to add another property in the area to our portfolio.

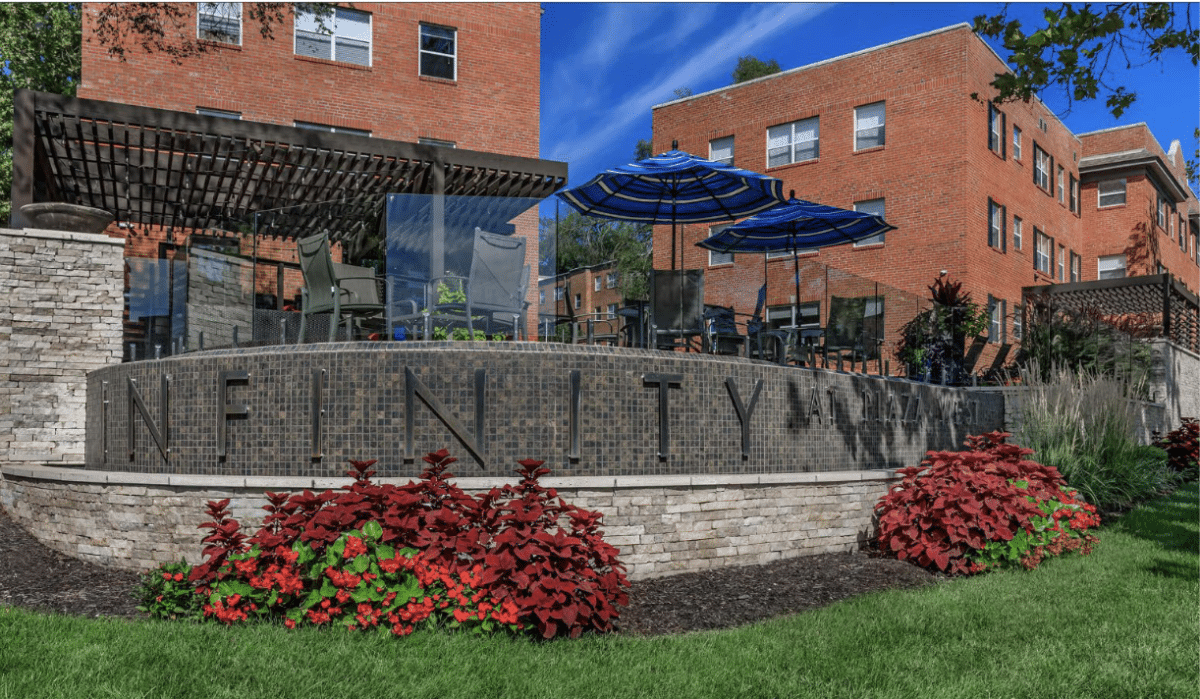

Specifically, we’ve officially closed on Infinity at Plaza West, a 224-unit garden-style multifamily community.

The following is a report from our findings on the deal details as well as our impressions from the site visit.

Stats of the Deal:

Purchase Price: $29,290,000

Equity Required: $9,000,000

Projected IRR to PPR: 23.45%

Hold Period: 3 years

PPR’s Role in the Project: Provide equity for acquisition and provide ongoing asset surveillance of the property.

Why We Like This Deal

- Loan assumption with a favorable 3.90% interest rate with six years until maturity

- Recent $100MM retail/office investment by the Hunt family group into the nearby Country Club Plaza (3 blocks away)

- Property acquired from distressed seller allowed us to purchase at below-cost basis

- Possible cross-occupancy by student-housing tenants since there are multiple medical universities nearby

- Excellent prior working relationship with co-sponsor and property management provider

- Property has a history of consistent high occupancy rates

Location

Due diligence in multifamily acquisitions is critical, and a big part of that is location. This property is approximately three miles south of downtown Kansas City and 30 minutes north of our previous Kansas City acquisition. On top of this, it’s located in close proximity to the Country Club Plaza, Kansas City’s premier retail and lifestyle destination. Additionally, the free KC Streetcar line that travels from downtown Kansas City southward is expanding out to the Country Club Plaza and will be complete later in 2025.

In short, we believe that this property is in a prime location that is growing steadily year by year.

Site Visit

In late 2024, we conducted a site visit where we personally toured the property. During the windshield tour of the area prior to the site visit, we observed similarly-aged properties and single-family dwellings amongst large tree-covered streets nearby.

The property sits along a four-lane boulevard that directs into the Country Club Plaza—a “live-work-play” community just south of the West Plaza submarket. There is plenty of street parking available around the property.

The on-site management team is fully staffed and includes an assistant manager, a full-time leasing agent, a maintenance supervisor, and one maintenance technician. The property manager believes this is an appropriately sized team for the property; however, he did feel that a part-time porter position to assist the maintenance staff is something to consider upon takeover.

Occupancy at the time of the site visit was at 92%, and the property has experienced years of consistent, stabilized occupancy. Tenant demographics range in age and occupation, with many of the residents attending Kansas University-Medical School located nearby. Units vary from classic units, to enhanced, to fully renovated. The units are generally in great condition, with many of the studios featuring large closets. The units follow similar floor plan layouts dependent on the bedroom count. There is currently a waitlist for renovated one- and two-bedroom units.

On-site amenities include a leasing office, fitness center, pool with bathrooms, club room, and dog park. The amenity package is considered A-level and is not offered in competing apartment complexes located nearby.

Business Plan

At PPR, when looking at multifamily opportunities, we seek out value-add opportunities in growing locations, and that’s exactly what we secured with this acquisition. Our plan is to renovate the remaining 90 units and increase rents over a three-year period since the current property unit rate pricing is below market.

Additionally, we plan on doing simple upgrades throughout the property, such as installing outdoor gathering spaces throughout the community. We also want to spruce up the exteriors by bringing in landscaping to highlight the grounds.

The Risks

In any property built 70+ years ago, one risk to consider is that upgrades may be delayed due to the aging structure of the property. However, while the property was built in 1949, based on our thorough inspection, this is a risk we’re prepared for and have accounted for in our acquisition criteria.

An inspector had been on-site earlier in the week to perform a summary inspection of the entire property. The preliminary assessment concluded that the brickwork was in good condition, all roofs were in good condition with the exception of one, and the windows that were replaced in the last 10-15 years remain in good condition.

A Property Condition Assessment (PCA) report that was conducted in 2018 resulted in no critical repairs and only $2K in priority repairs, which is very favorable from a buyer’s perspective. However, an additional PCA will be conducted now to ensure that all risks are carefully evaluated.

Ready to Invest?

If you’re interested in learning more about our commercial real estate acquisition and disposition strategy or want to discuss investment options in our fund, please feel free to schedule a no-obligation consultation with us today.